Swing trading STRATEGY FROME FX ACCURATE

About Swing trading STRATEGY FROME FX ACCURATE

What is Forex Swing Trading?

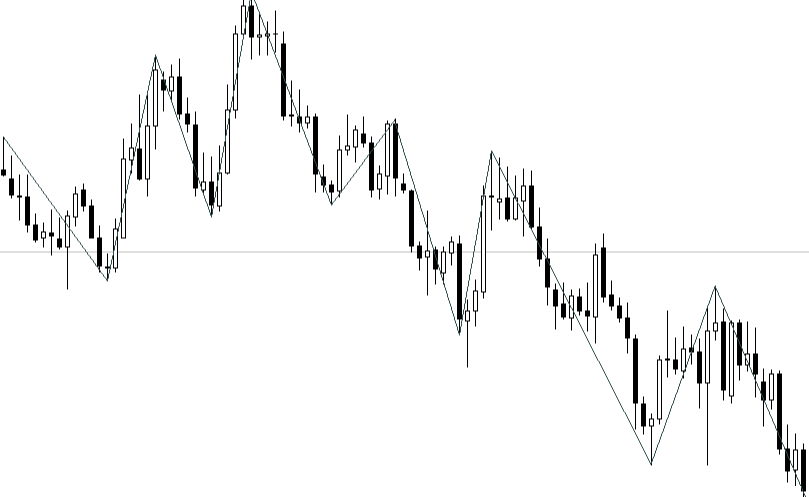

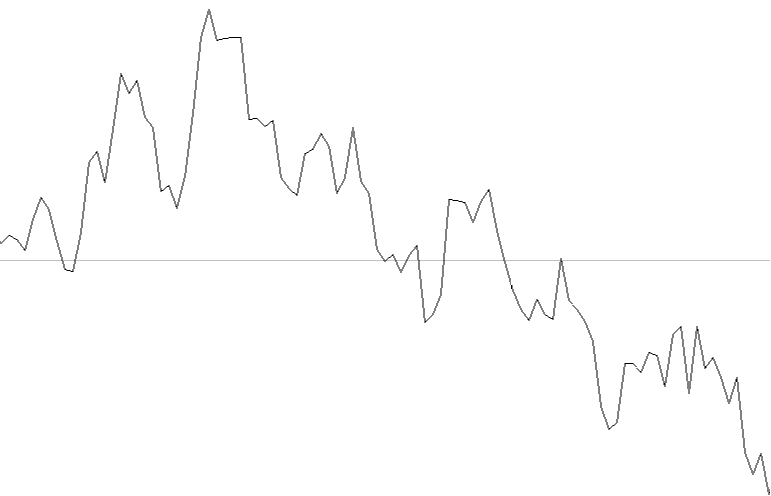

As the name suggests, swing trading is an attempt to make a profit from the swings in the market.

These swings are made up of two parts—the body and the swing point. As traders, it’s our job to time our entries in a way that catches the majority of each swing body.

While catching a swing point can be incredibly attractive, it is not absolutely necessary.

In fact, attempting to catch the extreme tops and bottoms of swings can lead to an increase in losses. The best way to approach these trades is to stay patient and wait for a price action buy or sell signal.

I’ll get into those various strategies shortly. For now, just know that the swing body is the most attractive part of any market move.

Forex swing trading is one of the most popular trading technical strategies and for good reason.

This allows for a less stressful trading environment while still producing incredible returns. This is great if you have a day job or want to go to school.

Having accurate levels is perhaps the most important factor. If you can’t rely on the support and resistance levels on your chart, you won’t be able to trade with confidence.

In my experience, the daily time frame provides the best signals. Just make sure you use New York close charts where each session ends at 5 pm EST. Check with your broker to be sure.

The best way to remove emotions from trading and ensure a rational approach to the markets is to identify exit points in advance. If you wait until you have an open position, it’s too late.

Above all, stay patient. Remember that it only takes one good swing trade each month to make considerable returns.

Swing Trading Entry

Forex swing trading is one of the most popular trading technical strategies and for good reason.

This allows for a less stressful trading environment while still producing incredible returns. This is great if you have a For entries on long positions, you look for a swing point low. trade on short sell positions you look for a swing point high.

reversals using swing points

1. long positions – last bearish candle The candle after that should be up

2. short positions – last bullish candle The candle after that should be down

stop-loss/take-profit

long positions- stop-loss =last low,take-profit=swing high

short positions-stop-loss=swing high,take-profit=last low

%

success rate formula

Enter the world’s largest trading market with fxaccurate. Whether you are exclusively trading currency or using your current portfolio as a currency to further diversify, we at fxaccurate will provide you with the most profitable, reliable and reliable Premium Forex Service.