price action trading

Must Know Price Action Trading Strategies

Do you know that price action trading strategies are one of the most commonly used methods in today’s financial market? Whether you are a short-term or long-term trader,

analyzing the price of a security is probably one of the simplest, yet most powerful, ways to gain an edge in the market.

After all, every single trading indicator in the world derives from value, so it really makes sense to study it,

understand it, learn from it, and use it in your trading. In this article, we offer everything you need to know about price action trading such as:

what is price action and why you should consider trading price action forex – plus – how to trade four price action trading strategies.

price action

.

What is Price Action?

The term ‘price action’ is simply a study of a security price movement.

In price action trading, traders will have to study historical value to identify any clues where the market may move.

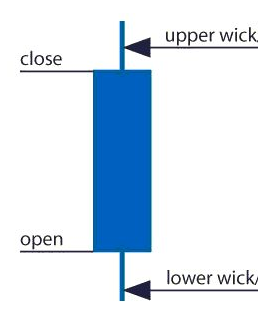

The most commonly used price action indicator is the study of price bars that give details such as the open and closed price of a market and its high and low price levels during a specific time period.

Analysis of this information is the core of price action trading. In fact, in answering the question ‘What is price action?’,

It can be said that it is in fact a study of the actions of all buyers and sellers actively involved in any given market. Therefore, by analyzing what the rest of the market participants are doing, it can give traders a unique edge in their trading decisions.

The most commonly used price bars that are used as price action indicators are called candlesticks.

All trading platforms in the world offer candlestick charting – proving how popular price action trading is.

What is a Price Action technical Indicator ?

As discussed above, we now know that price action is the study of the actions of all buyers and sellers who are actively involved in a given market.

The most commonly used price action indicator is a candlestick, as it provides useful information to the trader such as the opening and closing prices of a market and the high and low price levels over a user-defined time period.

Let’s look at an example:

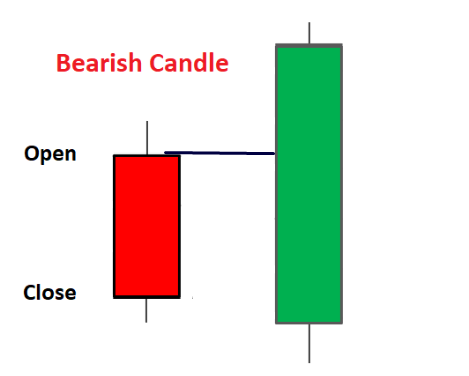

If you were to look at the daily chart of a security, the above candles represent the value of a full day’s trading. Both candles provide useful information to a trader:

The high and low price levels tell us the highest price and lowest price made on a trading day.

The seller candle, which is shown with a black or sometimes red color, the body tells us that the sellers won the Battle of the Trading Day. This is because the closing price level is lower than the initial price level.

The buyer candle, which is shown with a white or sometimes green color, the body tells us that the buyers won the trade battle. This is because the closing price level is higher than the initial price level.

The use of this simple candle setup is one of the first steps towards creating a price action strategy. for example:

If after the seller candle, the next candle moves to make a new low then it is a sign that the seller is ready to sell the market. Due to this weakness some traders will have to start small positions or occupy small positions they already have.

If after the buyer candle, the next candle goes to make a new high then it is a sign that the buyers are ready to buy the market. This strength will cause some traders to initiate longer (buy) positions, or to hold onto already longer positions.

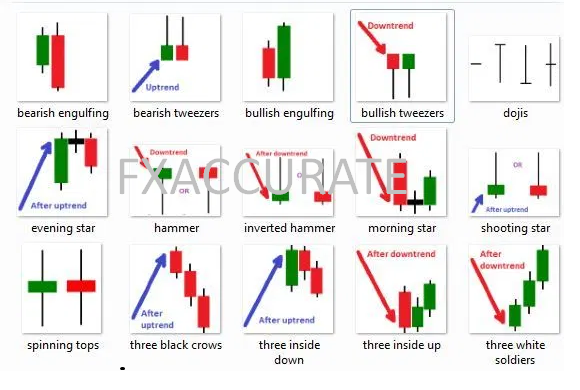

This type of price action analysis is just one way of using candlesticks as a price action indicator. However, the candles themselves often create patterns that can be used to create a price action strategy. Before we look at these patterns, let us first see where they work best.

Price Action Forex Trading

As price action trading involves the analysis of all buyers and sellers operating in the market, it can be used on any financial market. This includes forex, stock index, stocks and shares, commodities and bonds. You can see the instruments within all these markets on the candlestick chart and, therefore, apply a price action strategy to them.

However, there are some specific advantages for price action traders in the foreign exchange market, such as:

Open 24 hours a week, five days a week – a true representation of buying and selling in all continents.

Large liquidity – You are able to trade in and out of markets within nanoseconds.

Low spreads – Some, not all,

foreign currency currency pairs offer lower spreads that can keep the cost of traders’ commissions down.

Leverage – Forex trading is a leveraged product which means that you can control a large position with a small deposit.

This can mean big wins but also big losses, so please trade responsibly.

These are some of the reasons why price action forex trading is popular.

In the next part, we will use the price action forex as an example before proceeding to the forex price action scaling strategy.

Price Action Trading Strategies

A business strategy requires three different elements: why, how and what.

‘Why’, this is why you are considering trading a specific market. This is where price action patterns come into use. Through your price action analysis, you will gain an edge on what is likely to happen next – the market is going up or down.

‘How’ is the mechanics of your business. In short, this is the way in which you will do business. This analysis involves knowing your price level for entry, stop-loss and target. After all, trading is all about possibilities, so you should protect yourself, and minimize losses, according to market moves against your position.

‘What’ is the result of business. What do you want to achieve with this? Is this a short term business or a long term business? It comes down to how you manage the business to profitability and manage yourself if the result is not what you want.

Price Action Strategy > Hammer

The hammer price action pattern is a bullish sign indicating a high probability of the market rising to a low and is mainly used in up-trending markets. Here is an example of what a hammer candle looks like:

A hammer pushes sellers to a new low market. However, sellers are not strong enough to stay low and choose to bail on their positions. Due to this, there can be a boom in the market, due to which buyers can also step into the market. Both open and closed price levels should be in the upper half of the candle. Traditionally, the close may be below the open, but this is a strong indication if the close opening value is above the levee.

In the price action forex chart above, there are two examples of a hammer pattern – both highlighted in gold boxes. The pattern through analysis of open, closed, high and low price levels suggests that a move is likely to be high. In these instances, the price went higher after the candles were made. Of course, this will not always be the case but how can you trade it

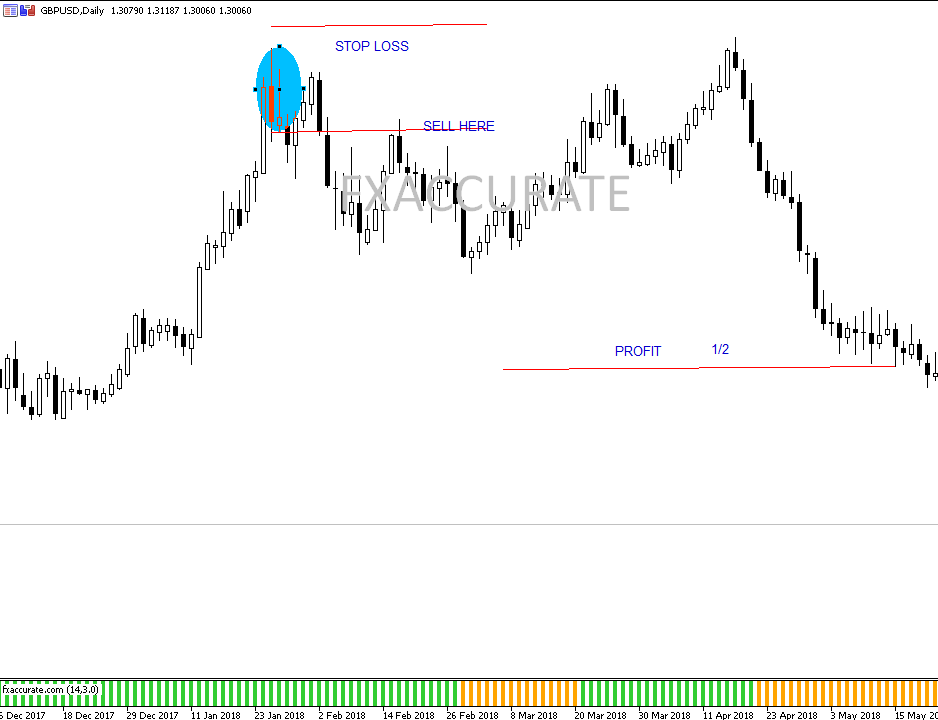

Price Action Strategy >Shooting Star

The shooting star price action pattern is a sign of a slowdown indicating a higher probability of the market moving from high to low and is mainly used in down-down markets. In short, it is the opposite of the hammer pattern.

Here is an example of what a shooting star candle looks like:

A shooting star pushes the market to a new high for buyers. However, buyers are not strong enough to stay high and bail in their positions. This reduces the market decline, leading vendors to enter the market. The open and closed price levels should be in the lower half of the candle. Traditionally, the close may be above the open, but this is a strong signal if the close is below the initial price level.

In the GBP / USD above price action forex chart, there are three examples of the shooting star pattern – all highlighted in gold boxes. The pattern through analysis of open, close, high and low price levels suggests that a move is less likely. In these instances, the price decreased after the candles were made. Of course, this will not always be the case but how can you trade it