abcd advanced pattern

About abcd advanced pattern

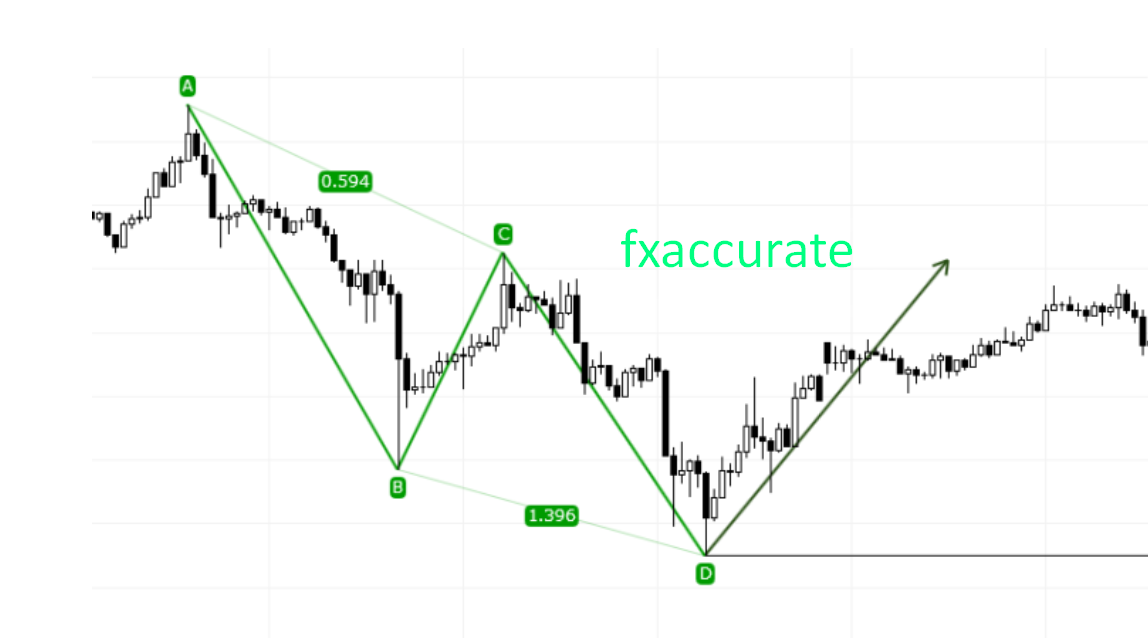

ABCD Pattern:

Equipment

o Fibonacci retracement: 61.8% of primary use.

o Fibonacci expansion: used primary 127.2% and 161.8%.

Timeframe

o The ABCD pattern was designed as a day / swing trading strategy. this

Can be identified at any time frame and viewed as information

Other Advanced Patterns.

Ics strategy

o Strategy for ABCD pattern is similar to other well known

Advanced Pattern. We want to identify 3 market moves and 2 major

Fibonacci region. A combination of these moves makes 4 points

(A, B, C, D) that completes the pattern.

Rules of engagement: Criterion 1

The ABCD pattern begins with a market movement / impulse leg that establishes

Our A and B numerals.

Once the A and B digits are identified, we then look for our first criteria.

Criterion 1: Market completes at least 61.8% (C) completion point

Abbey foot artifacts.

Note: BC The move remains valid as long as it is at least 61.8%.

A candle is not closed beyond AB’s retracement and 78.6%

Abby’s Retain.

Note: C can move past the endpoint (Candlewick)

61.8% retracement of AB until the candle is closed

AB’s 78.6% retracement.

Rules of engagement: Criterion 2

If criterion 1 is met, see criterion 2.

Criterion 2: The market makes point (D) completion point by meeting at least one

A harmonic speed of AB leg coming at 127.2% expansion

AB BCE ratios can be a measurement to confirm confluence.

Should be taken and the expansion should come to around 138.2% a

161.8%.

Note: The D point remains valid as long as it is at least 127.2%

AB’s expansion is not a candle beyond 161.8% AB.

Note: In a valid CD trick, there must be at least 127.2%. Failed to

Getting 127.2% invalidates the pattern.

Business Management: Entrances, Stops, and Targets

Simple rule

Penetration: The boundary was placed at the D completion point (127.2% of AB).

Stop Placement: 10 pips +/- 161.8% AB Exp.

If a longer entry, the stop goes 10 pips below the 161.8% expansion of AB.

If a small entry goes 10 pips above the 161.8% expansion of stop AB.

Goal 1: 38.2% AD speed. Stops when received

Break – Even.

Goal 2: 61.8% retracement of the AD move. When received, stop the structure mark

+/- 10 pips.

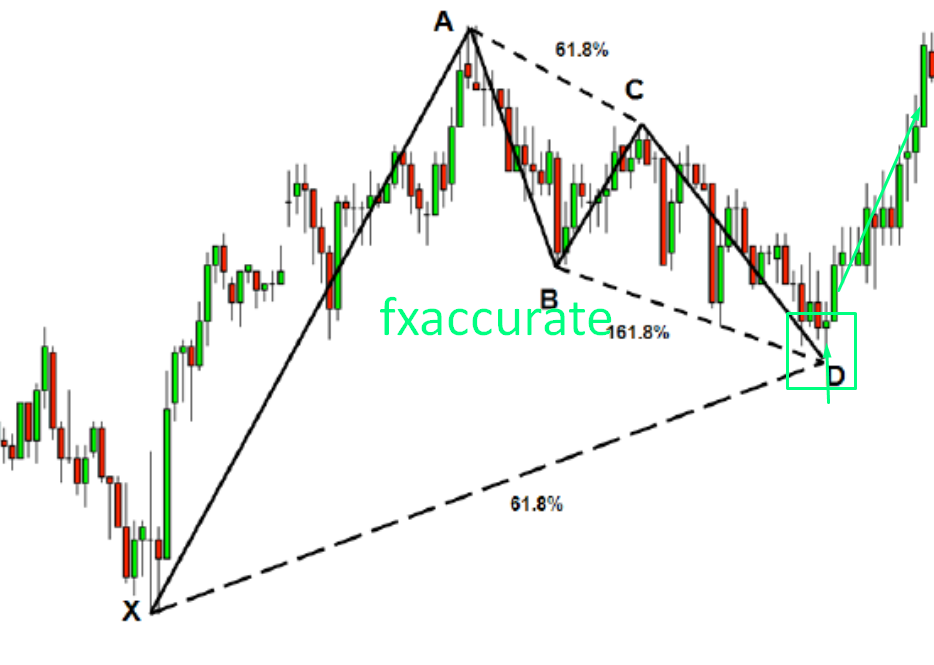

About Gartley Pattern:

Gartley Pattern:

Equipment

o Fibonacci retracement: primary use (61.8% and 78.6%)

O Fibonacci Extensions: (127.2%)

Timeframe

The O Gartley pattern was designed as swing / position trading

Strategy. It was originally discovered in 1935 by H.M Gartley. this

The pattern can be identified in virtually any time frame.

Ics Strategies for the O Gartley pattern are similar to other wells

Improved advanced patterns such as bats or butterflies. With gartley

The pattern we want to identify 4 market moves and 3 major Fibonacci

Zones. Points (X, A, B, C, D) are formed by combining these moves.

Which completes the pattern.

Rules of engagement: Criterion 1

The Gartley pattern begins with a market movement / impulse leg

Installs our X and A digits.

Once the X and A points are identified, we then look for our first criteria.

Criterion 1: The market completes point (B) by completing at least 61.8%.

Retention of XA leg.

Note: The AB move is valid as long as it is at least 61.8%

XA’s retracement and it doesn’t touch or come close to it

78.6% retracement of XA.

Note: B Endpoint (Candlewick) may expand and close

Unless the candle is beyond XA’s 61.8% retracement

Touch or close beyond XA’s 78.6 Rebalances.

Rules of engagement: Criterion 2

If criterion 1 is met, see criterion 2.

Criterion 2: The market makes at least 61.8% (C) completion point

Abbey foot artifacts.

Note: The C point remains valid as long as it is at least 61.8%

AB’s artwork and there is not a candle on or off it

AB’s 78.6% retracement.

Note: A valid BC In move, a candle must be beyond

61.8% value. Failure to get a candle beyond 61.8%

Invalidates this step (this would be considered a Fibonacci failure

Which has no relevance to this pattern).

Rules of engagement: Criterion 3

If criteria 1 and 2 are met, see criterion 3.

Criterion 3: The market makes a completion (D) completion (entry point)

127.2% expansion of AB.

Note: In a valid CD trick, 78.6 retracement of XA (D completion)

Point) shows the ratio confluence with AB’s 127.2%. D is completing

The point cannot extend X, it invalidates the pattern.

Business Management: Entry, Pause and Goals

Simple rule

Penetration: Limit placed at point of D completion (127.2% of AB).

Stop Placement: 10 pips +/- x.

If a long entry goes 10 pips below stop x.

If a small entry goes 10 pips above stop x.

Goal 1: 38.2% retracement of AD leg. When received, move to stop.

Goal 2: 61.8% retracement of AD leg.

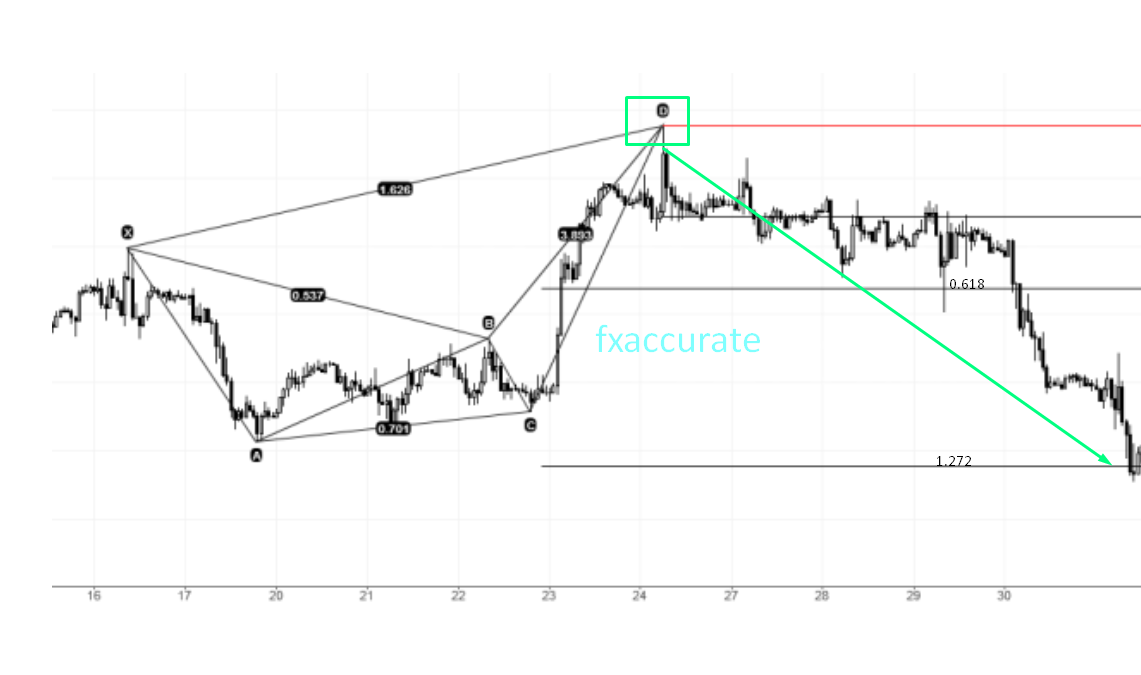

About Butterfly pattern

Butterfly pattern

Equipment

o Fibonacci Retracement: 78.6 is used in primary

o Fibonacci extensions: primary 127.2 is used

Deadline

o The butterfly pattern was discovered by Bryce Gilmore as a swing /

Situation Trading Strategy. It can be identified by virtually anyone

time limit.

Ics strategy

o The strategy for the butterfly pattern is similar to other wells

Advanced patterns like bats or crab. With butterfly

The pattern we want to identify 4 market moves and 3 major Fibonacci

Zones. Points (X, A, B, C, D) are formed by combining these moves.

Which completes the pattern.

Rules of engagement: Criterion 1

The butterfly pattern begins with a market move / impulse leg that establishes

Our X and A numerals.

Once the X and A points are identified, we then look for our first criteria.

Criterion 1: Completion point of market form (B) by meeting at least 78.6%

Retention of XA leg.

Note: AB move is valid as long as it is at least 78.6%

The retention of XA and it does not exceed 88.6%.

Rules of engagement: Criterion 2

If criterion 1 is met, see criterion 2.

Criterion 2: The market completes point (C) by completing at least 38.2%.

Abbey foot artifacts.

Note: The C point remains valid as long as it is at least 38.2%

AB’s retracement and no candle of more than 50% or more

Abby’s Retain.

Note: A valid BC In move, a candle must be beyond

38.2% value. Failure to receive a candle beyond 38.2%

Invalidates this step (this would be considered a Fibonacci failure

Which has no relevance to this pattern).

Rules of engagement: Criterion 3

If criteria 1 and 2 are met, see criterion 3.

Criterion 3: The market makes a completion (D) completion (entry point)

127.2% expansion of XA.

Note: In a valid CD move, 127.2% retracement of XA (D completion)

Point) shows the ratio confluence of AB with 161.8%. D is completing

The point must extend past x.

Business Management: Entry, Pause and Goals

Simple rule

Penetration: Limit kept at point of D completion (127.2% of XA).

Stop Placement: 10 pips +/- 138.2% XA.

If a longer entry goes 10 pips below 138.2% of the XA.

If a small entry goes 10 pips above 138.2% of stop XA.

Goal 1: 38.2% retracement of AD leg. When received, move to stop.

Goal 2: 61.8% retracement of AD leg.

About Crab pattern

Crab pattern

Equipment

o Fibonacci Retracement: Primary Use 61.8

o Fibonacci extensions: primary use 161.8

Deadline

o The Crab pattern was discovered by Scott Carney as a swing.

Situation Trading Strategy. It can be identified by virtually anyone

time limit.

Ics strategy

o Strategy for crab pattern is similar to other well known

Advanced patterns such as bats or butterflies. We with crab pattern

Want to identify 4 market moves and 3 major Fibonacci zones.

The combination of these moves completes those points (x, a, b, c, d)

Pattern.

Rules of engagement: Criterion 1

The crab pattern begins with a market move / impulse leg that establishes us

X and A digits.

Once the points X and A are identified, we then look for our first.

Criteria.

Criterion 1: Market Form (B) completion point by completing at least 61.8%

Retention of XA leg.

Note: AB conduction is valid as long as there is at least one

61.8% retracement of XA and it does not close above

78.6%.

Rules of engagement: Criterion 2

If criterion 1 is met, see criterion 2.

Criterion 2: The market completes point (C) by completing at least 50%.

Abbey foot artifacts.

Note: The C point remains valid as long as it is at least 50%

AB’s artwork and there is not a candle on or off it

61.8% retracement of AB.

Note: A valid BC In gait, there should be a candle beyond 50%

value. Failure to obtain a candle beyond 50% is invalid

Gait (this would be considered a Fibonacci failure that is not

Relevance to this pattern).

Rules of engagement: Criterion 3

If criteria 1 and 2 are met, see criterion 3.

Criterion 3: The market makes a completion (D) completion (entry point)

161.8% expansion of XA.

Business Management: Entry, Pause and Goals

Simple rule

Penetration: Limit kept at point of D completion (127.2% of XA).

Stop Placement: 10 pips +/- 200% XA.

If a longer entry goes 10 pips below 200% of stop XA.

If a small entry goes 10 pips above 200% of stop XA.

Goal 1: 38.2% retracement of AD leg. When received, move to stop.

Goal 2: 61.8% retracement of AD . leg

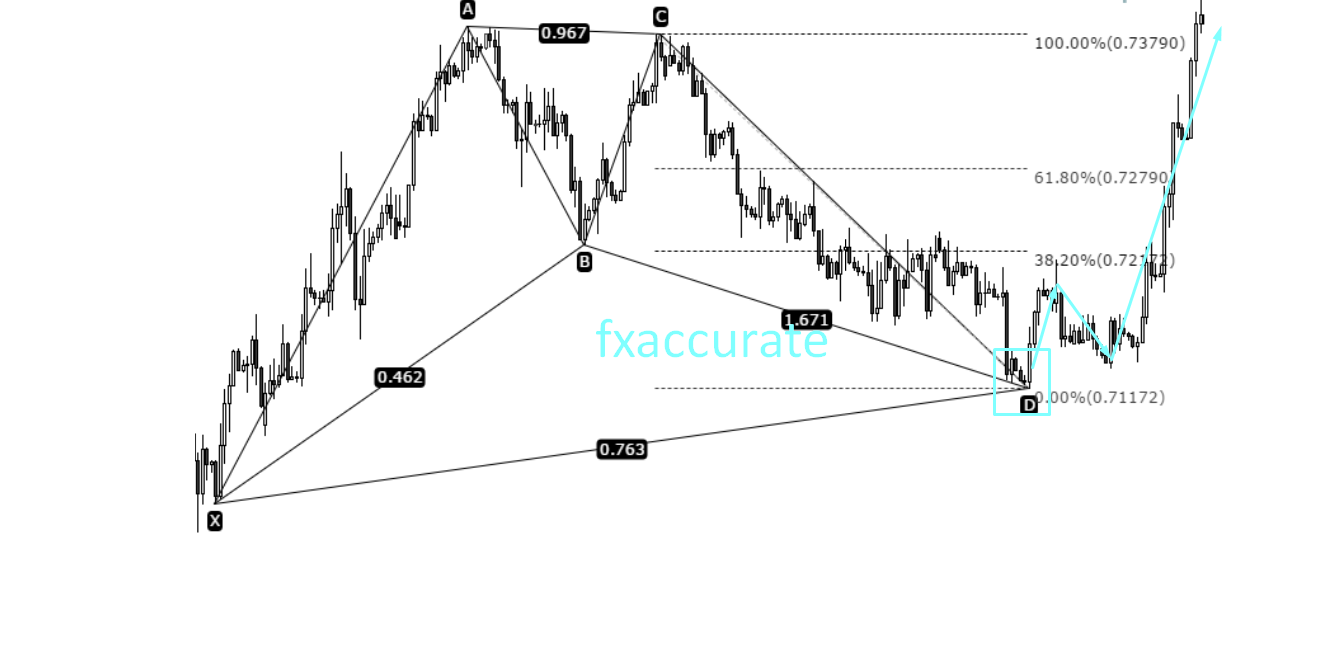

About Bat Pattern:

Bat Pattern:

Equipment

o Fibonacci retracement: primary use 50%

O Fibonacci Extensions: (127.2%)

Timeframe

o The bat pattern was designed as a swing / position trading strategy. this

Originally discovered by Scott Carney. This pattern can be

Identified in virtually any time frame.

Ics strategy

o Strategy for bat pattern is similar to other famous

Advanced patterns such as Gartley or Butterfly. With bat pattern,

We want to identify 4 market moves and 3 major Fibonacci regions.

The combination of these moves completes those points (x, a, b, c, d)

Pattern.

Rules of engagement: Criterion 1

The bat pattern begins with a market movement / impulse leg that establishes

Our X and A numerals.

Once the X and A points are identified, we then look for our first criteria.

Criterion 1: The market completes point (B) by completing at least 50%.

Retention of XA leg.

Note: AB conduction is valid as long as it is at least 50%

XA retracement and it does not close above 50%

Retracement of XA.

Note: B can move past the endpoint (Candwick)

50% retracement of XA until the candle is exceeded

50% retracement of XA.

Rules of engagement: Criterion 2

If criterion 1 is met, see criterion 2.

Criterion 2: The market makes at least 61.8% (C) completion point

Abbey foot artifacts.

Note: The C point remains valid as long as it is at least 61.8%

AB’s artwork and there is not a candle on or off it

88.6% retracement of AB.

Note: A valid BC In move, a candle must be beyond

61.8% value. Failure to get a candle beyond 61.8%

Invalidates this step (this would be considered a Fibonacci failure

Which has no relevance to this pattern).

Rules of engagement: Criterion 3

If criteria 1 and 2 are met, see criterion 3.

Criterion 3: The market makes a completion (D) completion (entry point)

161.8% expansion of AB.

Note: In a valid CD move, 88.6 retracement of XA (D completion)

Point) shows the ratio confluence of AB with 161.8%. D is completing

The point cannot extend X, it invalidates the pattern.

Business Management: Entry, Pause and Goals

Simple rule

Penetration: Limit placed at point of D completion (127.2% of AB).

Stop Placement: 10 pips +/- x.

If a long entry goes 10 pips below stop x.

If a small entry goes 10 pips above stop x.

Goal 1: 38.2% retracement of AD leg. When received, move to stop.

Goal 2: 61.8% retracement of AD leg.

About Cipher Pattern:

Cipher Pattern:

Equipment

o Fibonacci retracement: primaries used (38.2 and 78.6)

o Fibonacci extensions: primary used (127.2 and 141.4)

Timeframe

o The cipher pattern was designed as a day / swing trading strategy. this

Was originally discovered on the 60-minute chart and has since

Identified at virtually any time frame.

Ics strategy

o Strategies for the siref pattern are similar to other well-known advance patterns such as Gartley or Butterfly. With him

Cypher Pattern We want to identify 4 market moves and 3 major

Fibonacci region. A combination of these moves makes 5

Numerals (X, A, B, C, D) that complete the pattern.

Rules of engagement: Criterion 1

The siraf pattern begins with a market movement / impulse leg that establishes

Our X and A numerals.

Once the X and A points are identified, we then look for our first criteria.

Criterion 1: Market meets B (B) completion point by completing at least a

38.2 retracement of the XA leg.

Note: The AB move is valid as long as it is at least 38.2.

There is not a candle beyond XA’s retracement and 61.8

Retracement of XA.

Note: B absolute point (candle wick) can move beyond 61.8

Retracement of XA until the candle is closed beyond 61.8

Retracement of XA.

Rules of engagement: Criterion 2

If criterion 1 is met, see criterion 2.

Criterion 2: The market meets point (C) by completing at least one

127.2 extension of the XA leg.

Note: The C point remains valid as long as it is at least 127.2

XA is not a candle extending and beyond 141.4

Expansion of XA.

Note: A valid BC In the move, a candle must be closed outside of A.

value. Failure to obtain a candle beyond A invalidates the step

(This will be considered a double top / bottom which does not have any

Relevance to this pattern).

Rules of engagement: Criterion 3

If criteria 1 and 2 are met, see criterion 3.

Criterion 3: Market completes 78.6 (D) creates completion (entry point)

Distance of xc.

Note: A valid BC In move, 78.6 retracement of XC (D completion)

Point) must be greater than the distance of CB.

Business Management: Entry, Pause and Goals

Simple rule

Penetration: Limit placed at point of D completion (78.6 of XC).

Stop Placement: 10 pips +/- x.

If longer entry, stop goes 10 pips below X.

If short entry, stop goes 10 pips above x.

Goal 1: 38.2 of CD leg. When received, the move to stop increases.

Goal 2: 61.8 Cd leg retention.

Enter the world’s largest trading market with fxaccurate. Whether you are exclusively trading currency or using your current portfolio as a currency to further diversify, we at fxaccurate will provide you with the most profitable, reliable and reliable Premium Forex Service.